The Banking Masterclass – Part 4: The Canadian Mortgage Machine

"Stability leads to instability. The more stable things appear, the more dangerous the eventual outcome." - Hyman Minsky

In Part 3, we saw the fork in the road — credit can flow into productive lending that grows the economy or speculative lending that inflates asset prices.

Canada chose the speculative path. And one institution made sure we stayed there: the Canada Mortgage and Housing Corporation (CMHC).

What CMHC Was Supposed to Be

Founded in 1946, CMHC’s original mission was post-war:

Help returning soldiers buy homes.

Finance affordable housing.

Support stability in the housing market.

It was a modest, targeted backstop — a tool for national rebuilding.

What CMHC Became

By the late 1990s and 2000s, CMHC wasn’t just insuring mortgages — it was supercharging them:

Risk Transfer – Banks could issue mortgages with as little as 5% down, knowing CMHC would insure the loan.

Taxpayer Guarantee – If the borrower defaulted, CMHC (and by extension, the taxpayer) paid the bank in full.

Zero Skin in the Game – With default risk gone, banks could expand mortgage lending without fear — and without needing to balance it against productive loans.

The result? Housing became the safest, most profitable thing a Canadian bank could do.

The Shift in the Data

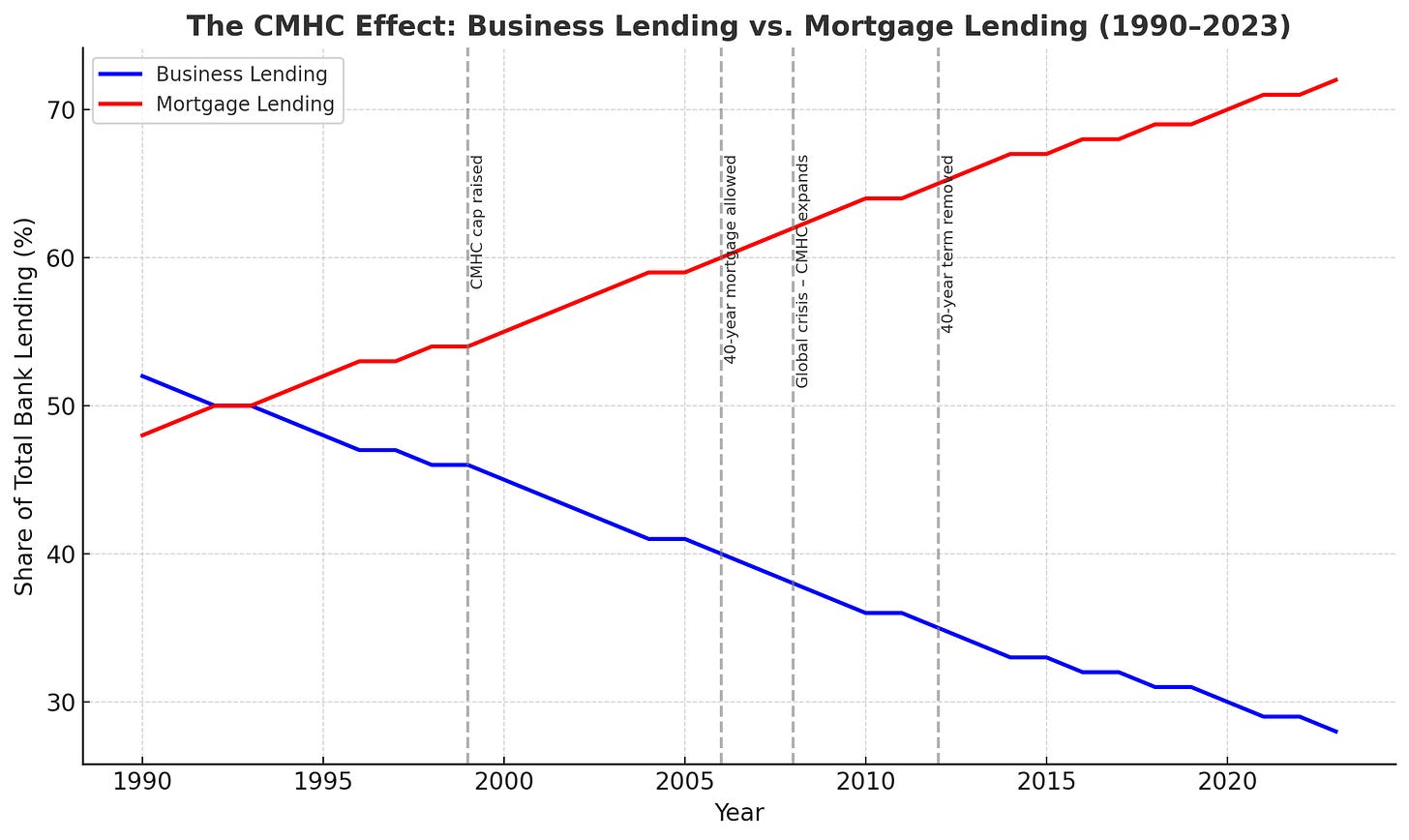

Before CMHC’s expansion, most bank lending still went to businesses.

Early 1990s: Business loans and mortgages were roughly balanced.

2000s: Mortgage lending began to overtake business lending.

By 2008: The gap had widened dramatically — and the trend never reversed.

Even during the 2008 global financial crisis, Canadian banks kept lending into housing. Why? Because CMHC guarantees insulated them from the crash.

The Political Hand on the Wheel

This wasn’t an accidental drift — it was reinforced by policy choices:

1990s–2000s: Liberal and Conservative governments raised CMHC’s insurance cap and loosened eligibility.

Mark Carney era (2008–2013): As Bank of Canada Governor, Carney publicly warned about household debt — but behind the scenes, the CMHC-insured mortgage machine kept pumping.

Finance Ministers from both parties leaned on housing as a growth engine, even as manufacturing declined.

Why This Locked Canada onto the Speculative Road

When banks know that one class of loan is:

Highly profitable,

Fully insured by the government,

Easy to originate,

…it becomes the default business model.

Over time, this changes the DNA of the financial system:

Fewer loans to entrepreneurs.

Less capital for productivity-enhancing projects.

More capital chasing the same houses — pushing prices ever higher.

The Illusion of Stability

Canada avoided the U.S.-style housing crash in 2008, and CMHC was hailed as the hero.

But what really happened was moral hazard on a national scale:

The bubble didn’t pop — it just kept inflating.

The risk didn’t disappear — it shifted to the taxpayer.

Final Thought

CMHC didn’t just insure mortgages. It rewired the incentives of Canada’s entire banking sector, locking us onto the speculative path and making housing the beating heart of our economy.

In Part 5, we’ll follow the timeline of Mark Carney’s career alongside this credit shift — and show how one man’s policy choices aligned perfectly with the transformation of Canada into a nation of mortgage debtors.